A federal judge has blocked a rule issued by the Consumer Financial Protection Bureau in January in January Unpaid medical loan removed From a credit report of about 15 million consumers.

The ruling ruling by Scene Jordan of the US District Court of Eastern District of Texas, ordered that the rule was evacuated due to the detection of the court that the CFPB exceeds its right under the Fair Credit Reporting Act. After the CFPB issued the rules in January, the Consumer Data Industry Association, a business group for the Cornerstone Credit Union League and the Credit Reporting Industry, filed a lawsuit to stop it.

The court’s decision can affect around 15 million people who carry a medical loan of about 49 billion dollars on their credit report, a burden that could affect whether the lenders decided whether consumers such as hostage or auto loans have to expand the loan. At the time when CFPB issued the rule, agency noted This medical loan is a poor prophet whether a consumer will do well on other types of loans.

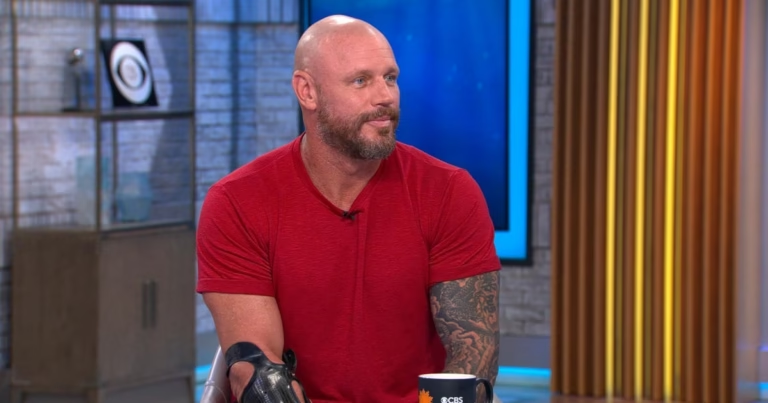

“It does not show that they are likely to pay their mortgage or other loans because there are lots of impurities and have a lot of controversies,” the consumer Financial Protection Bureau, former Associate Director of Monitoring and Regulation in the Consumer Financial Protection Bureau, told CBS Manivach.

The CFPB rule was designed by consumer advocates to help consumers who can get entangled in complex issues around medical loans, such as insurance reimbursement, refusal and problems with other snacks.

“By pulling back this rule, the court can work with his health care provider to provide that kind of relief to the CFPB’s capacity and give it certainty, to ensure that the bill they are paying, it is accurate, without hound by a loan collector, who currently serves as the president of the Century Foundation, to ensure that he can work with his health care provider.

What do you know here.

What does the ruling say about medical loan and credit report?

Jordan ruled that “the medical loan is more than the rule [CFBP]A law of the Statutory Authority, or FCRA, 1970, in violation of the plain text of the Fair Credit Reporting Act, oversees credit reporting.

“Rules have crossed the CFPB’s Statutory Authority as the FCRA clearly allows credit reporting agencies to report and use the credit reporting agencies, information about medical loans, which is properly coded to obscure the nature of the provider and the nature of services provided,” Dan Smith, CEO of Consumer Data Industry Empower. statement,

Was the CFPB rule came into force?

According to Jordan’s decision, no, the rule was not yet implemented.

While the rule was slate to be effective about 60 days after it was published, CFPB asked for a delay of three months, when the Trump administration put a new leadership on its top, the decision said. This request was given by the court as the case of blocking the rule proceeded.

Can the court’s decision be appealed?

This is not clear. While CFPB can appeal in theory, the agency is now essentially in the position of Limbo.

In February, President Trump appointed the White House Office of Management and Budget Director Ras Wout as acting director of CFPB. A few days after his appointment, vough A memorandum released CFPB for employees who direct employees not to issue any proposed or formal rules, prevent pending investigation and do not open new investigations among other functions.

What steps are available for consumers with medical loans?

In some states, consumers can rely on the security security to help in medical loans and their credit reports, said Margata Morgan. Both Colorado and New York enacted laws in 2023, for example, provide some protection to consumers who have medical loans.

And last year, three National Credit Reporting Agencies, Experience, Equifax and Transunion stated that they were removing medical collection loans under the US Consumer Credit Report under $ 500.

“My experience has a lot of flaws in our medical billing and reporting systems from consumers from consumers, and it is land in the consumer’s lap and they are going to find out how to deal with it,” said Margata Morgan. He said, “I will make sure that the bills you receive are accurate, as well as to check if your insurer is paying the right amount.