BBC

BBCThe strategy and multi-year plan before the review of this week’s spending is the bread and butter of any well-run economy.

A spending review shows how resources are being allocated between departments and therefore indicates the government’s “Jab-Kom-TU-Show” priorities. But this time it will “review different types of expenses”, saying the assistants of the Chancellor.

This is because it is about a year old with the new government, this expenditure review is a chance to show private sector and international investors that it has a confident, well -organized vision.

But the office was carefully tipped in its first year, the question is whether this government can explain to those potential investors that the economic vision is real? And will other long -term challenges such as industrial energy prices, social care costs and worker disease be preferred or parked?

‘Stop playing small domestic politics’

Some chief officials tell me that they cannot tell me that the government with such a large majority may sometimes be afraid of its shadow.

The Downing Street “desire for quarrel” was talked about on planning for the main projects. But companies that have prominent investors are waiting to invest in factories that can start for mass adoption of Green Technologies, wondering whether the Downing Street will actually return them, look at the elections, and potential pure zero backlash.

A major consumer company owner told me, “They need to stop small domestic politics.”

WPA Pool/ Getty Image

WPA Pool/ Getty ImageIt is keeping in mind the big investors that the Chancellor’s focus on review of this expenditure has been at the long -term capital expenditure – this is where a large number of number comes.

The ratio of the country’s GDP that is being kept for capital expenses is 2.7% on an average of five years. If he does not kill you as an eye water, it is worth noting that it will be at its highest continuous level for almost half a century. This will be much higher than brown-darling in 2010. This number was 0.5%in 2000.

Of course, allocating significant amount is not guaranteed that money will be spent effectively or at all. Expenditure on capital is often subject to rollercosters of short -term government priorities.

It is the first thing to be hacked back in a crisis, because the loss of future buildings or roads or rail lines is less politically troublesome than a public service cutting or, says, pay teachers here and in.

This is why under the new borrowing rules of the Chancellor, money can be allocated for at least large capital projects. His improvement in those rules-to keep them hard at day-to-day expense, but allowed more space for a conscious long-term investment-it was designed for.

The main goal is the growth of the future.

‘Time to resume the state’

Next week, long -term certainty on the capital amount being allocated either can be a gamechanger. Private investment is more likely to follow, if there are long -term plans, especially after so many years of political uncertainty.

As part of all this, the Chief Secretary of the Treasury is also announcing an increase in spending on research and development. It is designed to promote science -led development.

But the Marki project for this announcement will definitely be a long-awaited high-speed rail line between Liverpool and Manchester. It is a piece of forged infrastructure in the fire of UK’s industrial heritage, including the world’s first inter-city passenger line, and of course Stephenson’s rocket, original steam locomotives.

Now, 200 years from its launch in 1829, it can be time for another industrial revolution, type.

Roots

RootsBut do not make any mistake, the government has still had to make some big options, even within the more generous capital budget. The highest increase in defense spending announced last week is as capital expenditure.

When documents are published on Wednesday, it is possible that some other capital projects would have been squeezed to make rooms.

All departments have also assured the expenditure from the first principles, as part of the “zero-based” review. The entire projects in theory can hit the ax. It will also have a lot of “investment to spend less”. Using the capital budget to invest in AI scanners in healthcare, in a way, which is ultimately believed to save money.

Objective, ambitious, is “to resume the state” and “proceed to Britain”.

This is keeping in mind that Chancellor will promise that the government has learned lessons of debate that spends capital like HS2.

She believes that by waiting, and carefully formulating a infrastructure strategy, she is making sure that the expenditure will be where it will promote the most development. Freeing the supply, for example in the plan system, is going to help increase the reconstruction boom, but without provoking inflation.

Long shadow of Kovid -19

Those new lending rules freed spending on large projects, which also means tight settlements at day to day expense.

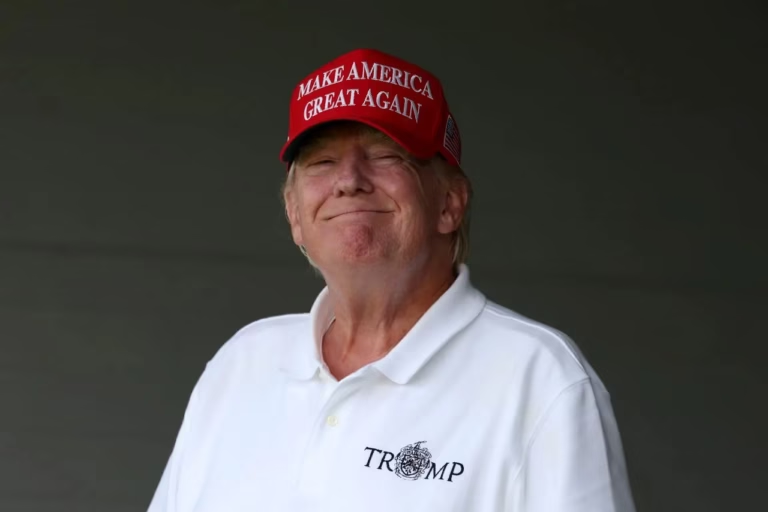

The travels of Elon Musk and Donald Trump show challenges for G7 countries in public finance management. And labor is working in an environment where some opposition parties are now advocating more radical surgery for the size of the state in the UK.

Also, when it comes to public spending, there is still long shadow than epidemic. The demand for intense services and benefits related to sick health and care, or special requirements, is eating far away in the budget for councils, schools and health.

The public expects more than the state since the epidemic, even if it does not want to stop taxes to pay for it.

PA media

PA mediaTherefore, budgetary pressure has not gone away. It is now difficult to square additional welfare expenses sticking to winter fuel payments and child benefits, additional defense spending, and some tax growth in autumn.

Rapid growth numbers, and an increase in confidence after a series of trade deals, can help add numbers, but there are also any economic uncertainty.

While there have been some stressful moments in the conversation with cabinet colleagues, all parties have already talked about a mini-cost review for this year.

But this is not to say that the Chancellor does not need to do a large -scale balance function: the demand for juggling is to add short -term budget numbers, while highlighting the long -term investment that can finally increase the economy.

BBC industry The best analysis is home on the website and app, with the latest approach that challenges beliefs and deep reporting on the biggest issues of the day. And we also demonstrate thought-respective materials from BBC sounds and iPlayer. You can send us your feedback on Inspth Section by clicking on the button below.