Washington -President Trump said that on Thursday he would nominate a top economic advisor for the Board of Governors of the Federal Reserve for four months, temporarily filling a vacancy by continuing his search for a long -term appointment.

Mr. Trump said that he has nominated Stephen Miran, president of the White House Economic Advisors to fill a seat. Empty By Governor Adriana Kugler, a biden appointment that is leaving the post on Friday. Miran, if approved by the Senate, will work till January 31, 2026.

“Stephen has a PhD in Economics from Harvard University, and served with distinction in my first administration,” Mr. Trump Truth written on social“He has been with me since the beginning of my second term, and his expertise is unique in the world of economics – he will do an excellent job.”

Appointment is the President’s first opportunity to keep more control over Fed, one of the remaining independent federal agencies. Mr. Trump has Constant criticism The current chair, Geom Powell, to keep the short -term interest rates unchanged, call them a stubborn Moran on social media last week.

Miran has been a major protector of Mr. Trump’s income tax cuts and tariff hikes, arguing that the combination will generate adequate economic growth to reduce the budget deficit. He has also taken a risk of Mr. Trump’s tariff Creating high inflationA major source of concern for Powell.

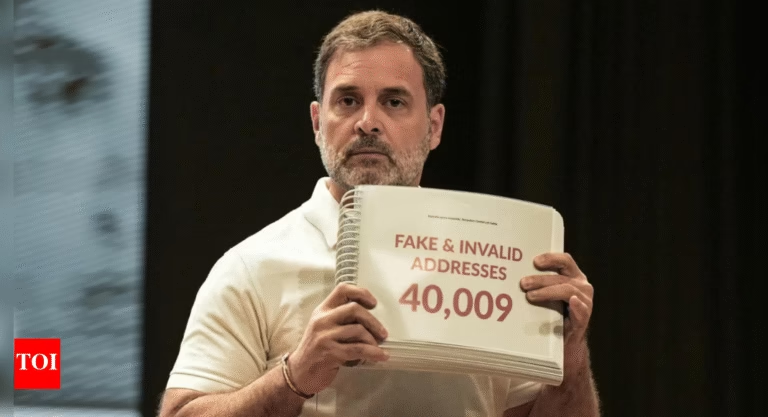

Aaron Schwartz/SIPA/Bloomberg via Getty Image

Miran’s choice can increase concerns about political influence on Fed, which is traditionally untouched by day-to-day politics. Fed independence is generally seen as important to ensure that it can take difficult steps to deal with inflation, such as raising interest rates, that politicians may not be ready to take.

The Federal Reserve Governors all vote on the interest-by decisions of the Central Bank as well as its financial regulatory policies.

Miran’s enrollment, if approved, will add a certain vote to support low interest rates. Kugler echoed Powell’s idea that the fed should keep the rates unchanged and evaluate the impact of tariffs on the economy before any step.

Last week fed officials in their most recent meeting Keep their major rate unchanged At 4.3%, where it stands after a three -rate deduction at the end of the previous year. But two Fed Governors – Christopher Waller and Mitchell Boman – separated from that decision. Both were appointed by Mr. Trump in their first term.

Nevertheless, with Miran on board, 12 Fed officials voted on the interest rate policy and many are worried that Mr. Trump’s broad tariffs may push inflation more in the coming months.

After the release of a July job report last Friday, Meeran criticized the Fed Chair for not cutting the benchmark interest rates, stating that Mr. Trump proved to be correct on inflation during his first term and would be again. The President has pressured Powell to cut short -term interest rates under the belief that his tariffs will not promote high inflation pressure.

Meeran said on MSNBC, “Now what we are seeing in real time is a repetition of this pattern once again, where the President will prove to be correct.” “And Fed Will, with an interval and perhaps quite late, will eventually catch the President’s approach.”